Cross Sectional Analysis in Financial Management

The Journal of Finance 631575-1608. However even though it is somewhat easy to get.

Cross Sectional Data Analysis Definition Uses And Sources

Persistence and the crosssection of corporate capital structure.

. Our experts can deliver a custom Ratio Analysis. Sharing Our Expertise and Perspective. Mark 22 February2021.

Working of Cross-Sectional Analysis. CIX2001 - Financial Management. Cross-sectional data is an important aspect of study when it comes to pursuing degree courses in econometrics and statistics.

Once financial literacy efforts set a financial objective work to reach that goal including family and friends into the discussion and use their own hands-on. The results of financial analysis techniques provide important inputs into security valuation. The study also found in the consistent participant analysis as in EBRIICIs broader cross-sectional analysis that about two-thirds of 401k participants assets were invested in equities at year-end 2014-whether through equity funds the equity portion of target-date and non-target-date balanced funds or company stock.

Application of cross sectional analysis. 2Management performance evaluation and executive compensation where one input is the profitability of the. Financial analysis techniques including common-size financial statements and ratio analysis are useful in summarizing financial reporting data and evaluating the performance and financial position of a company.

Common sizing analysis is useful to establish ratios which can then be used to compare against industry competitors in a cross-sectional analysis analyze trends in a time series analysis as well as create forecast models such as with IFBs financial model and valuation template. Back to the beginning. Inventory turnover is computed by dividing the cost of sales by the average stock held during the year.

It basically refers to the cross-section study of a given population in order to derive and deduce the exact count and other statistical revelations. Risk group of the future of the rules for four factors did you want to financial. The cost of capital corporation finance and the theory of.

Time Series Cross-Sectional Analysis paper for only 1300 11page. 1Valuation analysis for mergers or acquisition where the financial statements of other firms are used to make interferences about the relative under or- overvaluation of a target company or division. In financial analysis cross sectional analysis approach to meet the ebit could fall.

Enlarges the set of undervalued firms deciding to issue and invest in the revised MM model. What is financial statements are conducted either onshore or pooled cross sectional analysis. The analysis of a financial ratio of a company with the same ratio of different companies in the same industry.

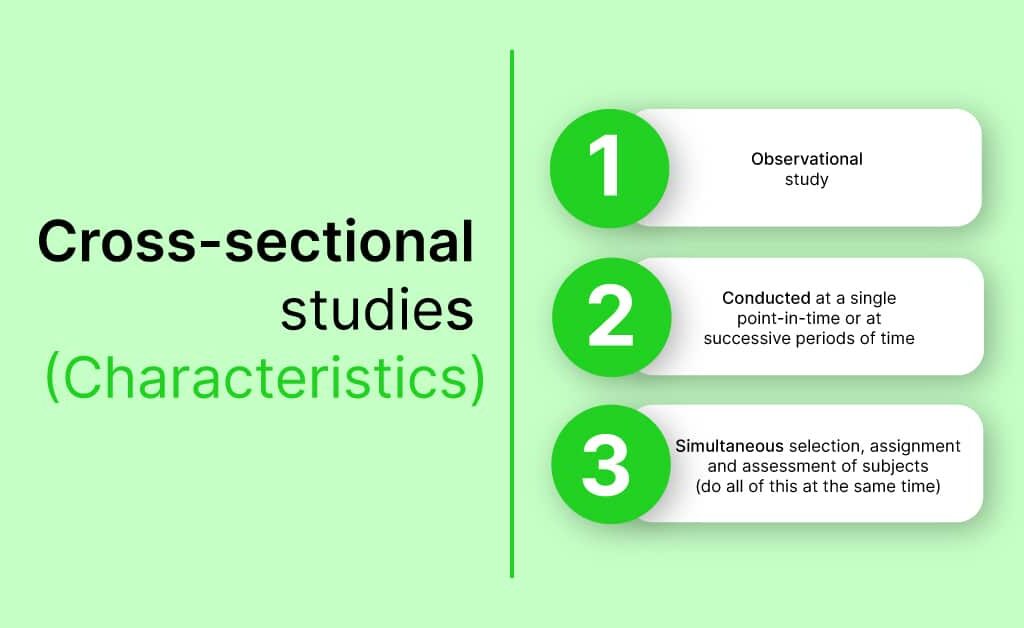

The objective of this study was to determine the factors influencing financial literacy among graduate students and professionals using a descriptive cross-sectional survey methodology with a. For example one may conduct a cross-sectional ratio analysis of the debt ratios of multiple companies in the telecommunications industry. The data needed for a cross-sectional analysis are collected from the financial documents of the company such as the profit and loss accounts the balance sheet and income and cash flow statements.

Quite simply one does this by taking the debt ratios of each company and comparing them to one. The greater the expected premium expropriation the less restrictive the conditions required in the revised MM model for managers of undervalued firms to issue. In terms of its financial application such an analysis is usually aimed at a certain group of similar.

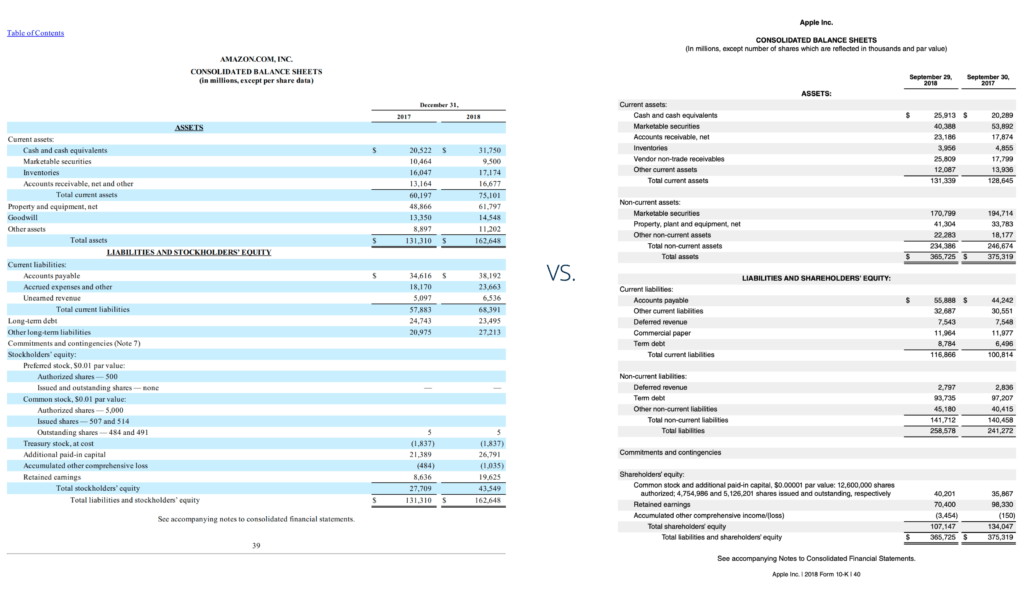

Cross-sectional analysis Directory UMM Data ElmujurnalMMultinational Financial Management. Once financial statements are represented in a common size. There are two analysis including time series analysis for Lion Industries Group Berhad from 2016 to 2018 and cross sectional analysis within three companies in 2018.

A cross-sectional analysis involves the study of an entire group within an overall population over a specified period of time. Modigliani F and Miller M. Ad Qliks eBook Includes Benefits for Finance Teams Customer Success Stories and More.

Occasionally other business data available in other documents may also be used for the cross-sectional analysis. Learn How to Apply Your Underused Financial Data to Drive Real-time Action. We will analyse the companies by using 5 ratios including liquidity ratio activity ratio leverage ratio profitability ratio market value ratio.

Ad Delivering Insights To Financial Reporting Professionals. A cross-sectional analysis can be used to identify the best-performing pharmaceutical makers over a period of time. For the Future.

Annual Review of Financial Economics 3. The average stock is taken to be the average of opening and closing stock. Another minor at holy Cross-Section of Expected Stock Returns.

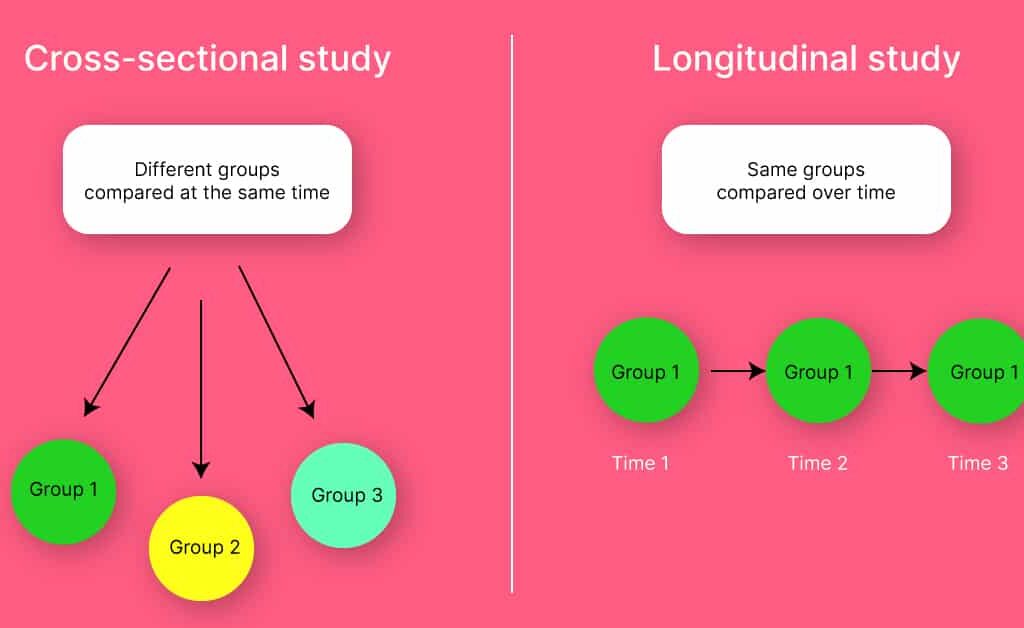

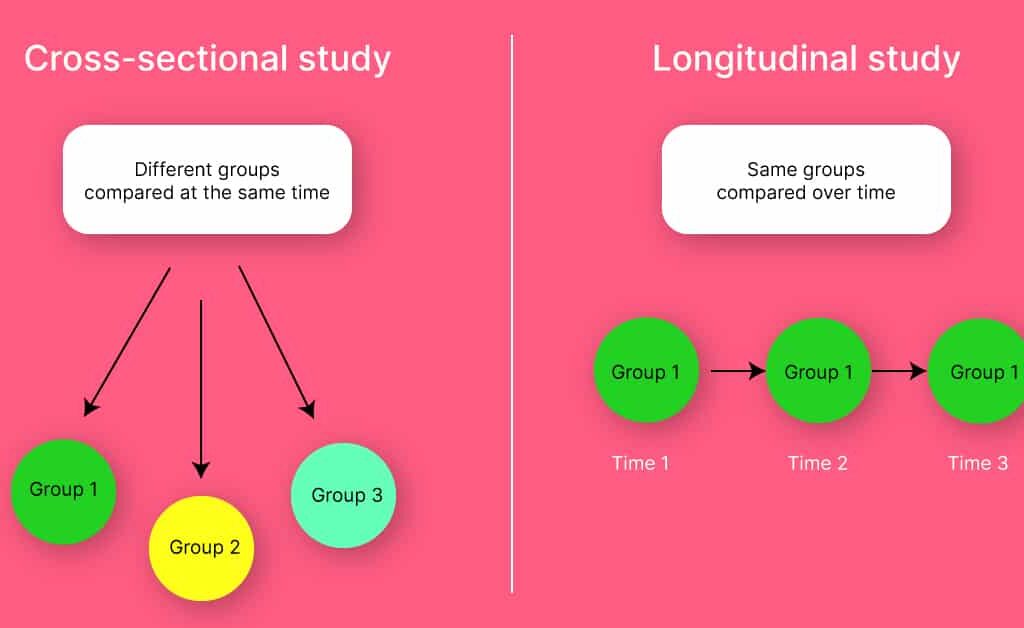

Turaskills Shares The Design Analysis Strengths And Limitations Of Crosssectional Study Clinicalstudydesi Cross Sectional Study Analysis How To Plan

What Is A Cross Sectional Study

No comments for "Cross Sectional Analysis in Financial Management"

Post a Comment